As the calendar of 2025 is about to turn over, China's economy has delivered a report card that has the world watching and even "shuddering": in the first 11 months, China's trade surplus exceeded the historic figure of 1.08 trillion U.S. dollars.

What kind of concept is this? This not only set a new record for the annual surplus of a single country in the economic history of mankind, but even exceeded the total GDP of most countries. If you look at the surface, this seems to be another ironic proof that Made in China is "winning". However, put aside the emotional interpretation, in-depth data texture, we will find that this "trillion surplus" is not the traditional sense of "prosperity carnival", it is more like a complex signal light, reflecting the Chinese economy is currently a unique "Strong supply, weak demand" unbalanced pattern.

This is not a simple report, this is a pressure test of the global trade pattern.

I. The "counter-intuitive" truth in the data: the widening of the scissor gap

First of all, we need to break a myth: the record surplus is not exactly the same as the "endless surge" in exports.

A closer look at the data from the General Administration of Customs (GAC) shows a typical "scissors gap" characterizing the expansion of the surplus in 2025 .Although the export side (especially in U.S. dollars) to withstand the pressure of tariffs to maintain a resilient growth of about 5-6%, but the other half of the surplus contribution, in fact, comes from the import side of the super-expected "calm".

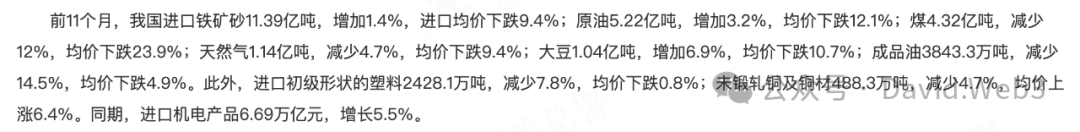

In the first 11 months, China's import growth hovered near 0% in many months, and even edged down in some months. This creates a huge difference in space. In other words, the trillion-dollar surplus is not only because we sell more to the world, but also because we buy back from the world (relatively) less.

This "asymmetric" trade flows, revealing the deeper logic of the current economic operation: China is through the strong industrial capacity to the global output of deflationary pressures, while the absorption capacity of the domestic market has failed to keep pace.

Second, the "stall" of domestic demand - from asset shrinkage to distributional mismatch

Why did this situation occur? In addition to the technical factors of exchange rate fluctuations, three structural pushers jointly shaped this historical extreme. 1.

1. The industrial chain's "downward spiral" and import substitution:

In the past, China was known as the "world's factory", often "big in, big out" - imported core components, assembly and then export. But now, this logic has been completely rewritten.

New energy vehicles and shipbuilding industry, for example, China not only in the end product to achieve an explosion of exports (ship exports in 2025 surged by more than 50%), more critical is that we have realized the entire industrial chain of localization. Previously need to import high-end steel, precision instruments, and even automotive chips, now domestic can be made. This "import substitution" effect greatly compressed the demand for imports. When China's manufacturing industry mastered all the links from the screws to the control system, to stay in the domestic value-added become higher, the flow of overseas purchasing funds will naturally be less. 2.

2. Domestic demand "chill" and "passive overseas":

This is a B-side of the coin that cannot be avoided. The deep adjustment of the domestic real estate market, as well as the deceleration of infrastructure investment, directly led to the marginal weakening of the demand for iron ore, coal and other commodity imports.

The deeper impact is that the recovery of the domestic consumer market lags behind the expansion of industrial capacity. When the huge industrial machine roars to life and domestic consumers choose to tighten their purse strings during the balance sheet repair period, "inward spillover" becomes the survival instinct of enterprises. Many manufacturing enterprises (such as photovoltaic, lithium-ion, home appliances) is not because of high overseas profits and exports, but because the domestic market "can not be rolled", forced to the ultimate cost-effective influx of overseas. This in economics with a certain "recessionary surplus" characteristics.

3. Tariffs under the stick "big detour" strategy:

Geopolitical tensions are also reshaping trade routes. Data show that China's exports to the United States declined significantly in 2025 (at one point by almost 30 percent), but this gap was filled by a surge in exports to ASEAN, Latin America and Africa.

This is a combination of real demand growth in the markets of the "Global South" and "re-export trade". A large number of intermediate goods and components first exported to Mexico, Vietnam and other places, after processing and assembly and then sold to Europe and the United States. This "roundabout tactics" although the total number of exports to maintain, but also makes China's surplus source of a huge geographic shift, further aggravating the trade imbalance between China and emerging market countries.

Third, domestic demand "stalled" structural foci

On the back of the trillion surplus, is China's domestic demand market, a "silent". 1.

1. The "negative wealth effect" of balance sheet (cyclical suppression)

The most direct reason for the sluggishness of domestic demand is the shrinking of household assets.

- Chain reaction of real estate: In the past two decades, 70% of Chinese residents' wealth has been tied up in real estate. As housing prices enter a period of adjustment (some cities have retreated 20-30% from their highs), residents feel "poorer". This "negative wealth effect" directly cut off consumer confidence.

- Not only do not buy a house: the downturn in real estate quickly transmitted to the downstream. Renovation, home appliances, furniture and other "residential consumption" fell off a cliff, which used to be the bulk of domestic demand.

2. Growth inertia of "investment over distribution" (structural mismatch):

The data reveal a long-standing structural contradiction: GDP growth has not been translated into disposable income growth in equal proportions.

- Distributional scissors: Our policy toolbox has long favored "supply-side reforms" (tax cuts for enterprises, infrastructure, and even subsidies for production capacity), with relatively little input on the demand side (direct payments to residents, and raising social security levels).

- Result: Enterprises get cheap credit to expand production (resulting in oversupply), while residents do not get enough money to consume (resulting in insufficient demand). This "strong production, weak consumption" macro-allocation pattern, is the root cause of the passive expansion of the surplus system. 3.

3. Preventive savings and the "low inflation trap" (psychological contraction):

When the macro data signal "overcapacity" and "price wars", the micro-individual's rational choice is "delayed gratification".

- Self-fulfillment of deflationary expectations: Consumers choose to "wait and see" since cars will go down in price next month and clothes will go on sale even more.

- Uncertainty premium: In the face of uncertainty about healthcare, pensions, education, and the pressures of the job market (especially the volatility of youth unemployment), the savings rate of Chinese households will remain high through 2024-2025. This huge amount of money is sinking into the banking system and idling, rather than being turned into purchasing power to absorb that $1.08 trillion of export capacity.

Fourth, the B side of the coin: can not be ignored cost and game

Trillion surplus certainly demonstrated the muscle of China's manufacturing, but in the current international environment, it is also a double-edged sword.

The first is the deterioration of the external environment. Such a huge surplus is providing the perfect "ammunition" for global trade protectionism. If the United States was the only one wielding the tariff stick in the past, now the anxiety has spread. Recently, not only the EU attitude is tough, even Brazil, India, Turkey and other emerging market countries have begun to launch anti-dumping investigations of Chinese steel, chemical products. The world is worried about the "second China shock" will cause a devastating blow to their industries. A 1 trillion dollar surplus economy, it is difficult in the current geopolitical "alone".

The second is the risk of internal macroeconomic imbalances. Over-reliance on external demand to absorb production capacity masks the urgency of reforming domestic distribution mechanisms. If you maintain export competitiveness by depressing factor prices (e.g., labor and environmental costs), although you get foreign exchange, it does not help solve the core contradiction of the lack of domestic consumption capacity. Once the external demand due to global recession or trade barriers and suddenly cut off the cliff, the domestic backlog of excess capacity will face a huge pain of de-consolidation.

Conclusion: from the "big exporting country" to "domestic demand power" of the necessary juncture

Standing at the historic high point of 1.08 trillion U.S. dollars, we not only want to see the achievements, but also want to see the hidden worries.

This trillion surplus, is the medal of China's manufacturing industry chain upgrading, but also the alarm bell of the lack of domestic demand. The future of the Chinese economy, can not and should not continue to rely on this imbalanced growth model.

A truly strong country, not only to have the ability to "sell" to the world , but also to have to "buy" from the world's bottom. The next policy center of gravity, will inevitably be from the simple "stabilization of foreign trade", to a deeper level of "expanding domestic demand" - through the financial power, enhance the proportion of residents' income, the huge industrial output into the real welfare of the people. The output of the huge industrial output into the real welfare of the people.

Only when Chinese consumers can digest a greater share of Made in China, this trillion surplus can really be transformed into a lasting impetus for high-quality economic development.