A number of honesty

In the first quarter of 2025, the Web3 space lost six billion dollars to rug pull. That number is up sixty-five times from $90 million in the same period in 2024. Not 65%, not 650%, sixty-five times. One of the projects, called Mantra Network, single-handedly contributed the lion's share of the losses - over $5 billion evaporated in a few days, more than the GDP of many countries. Instead, the number of rug pull events fell by 66%. There are fewer players at the table, but the chips in a single bet have gotten bigger and crazier.

Web3 didn't get safer, gamblers just learned to all in.

What is "casinoization"?

Many people's first reaction to the idea that Web3 is a casino is to be unconvinced. Every new technology has speculation, the NASDAQ during the Internet bubble is not the same? But casinoization is not as simple as saying "there is speculation". Zero-sum games trump positive growth.

Speculation is about earning the difference in value growth, whereas gambling is pure wealth transfer - every dollar you win is a dollar someone else loses. In Web3, the vast majority of projects have no real product, no users, and no revenue, and the value of the token comes entirely from the next buyer's bid. Information asymmetry to the extreme.

In a casino, the dealer always has more information than the gambler, VCs and project owners control most of the Token, and know when to ship, while ordinary players can only look at the K-line and guess at KOLs on Twitter. When you hear that a project is "about to take off", insiders may have already liquidated their positions. No exit mechanism.

Normal investments can be stopped out and diversified, but in Web3, when a project collapses, the Token can drop to 99% in a matter of minutes. Liquidity disappears, exchanges go down, and the Token in hand becomes a string of numbers.

Three sets of data, threefold truth

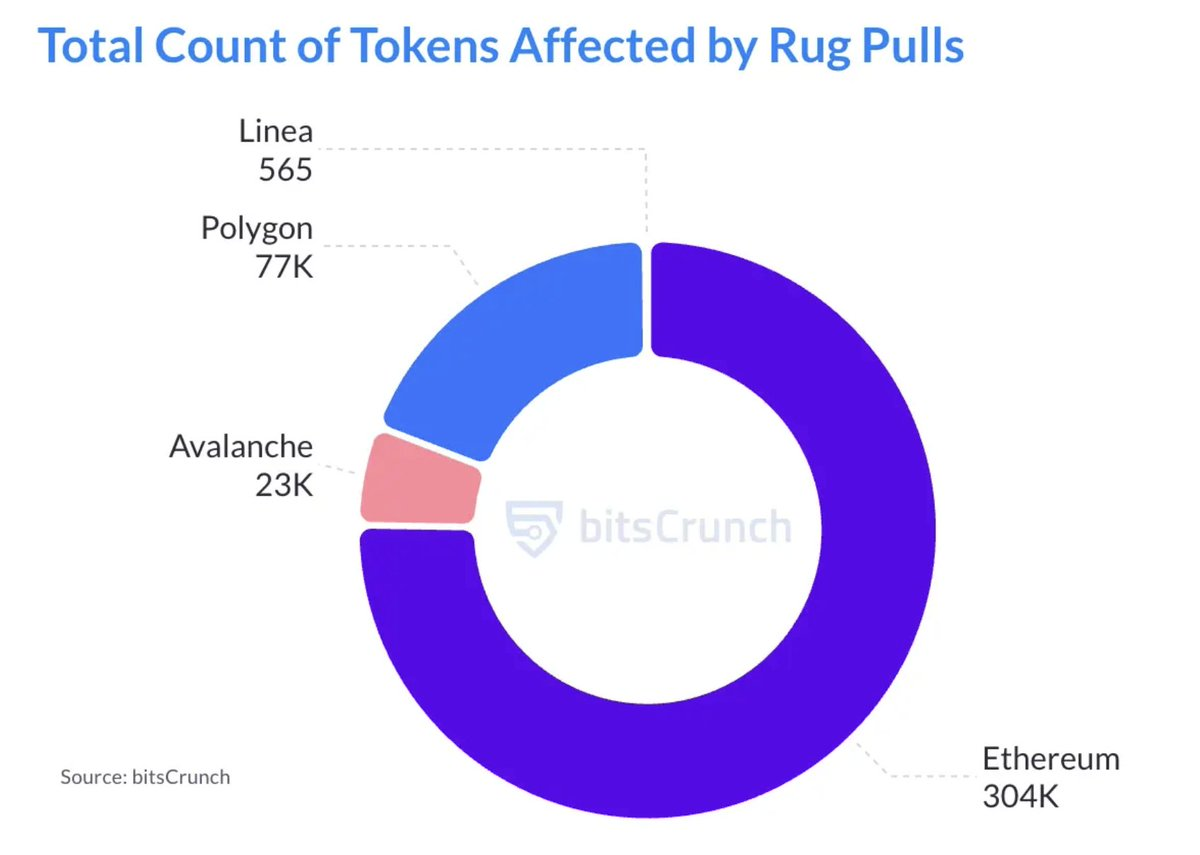

Truth 1: rug pull has been industrialized In 2024, more than 350 rug pulls occurred globally, with an average loss of nearly $100 million each. The average number of days from launch to crash is 12, which is shorter than the 21 days in 2023. This is not an isolated case, it's an assembly line. The project parties have figured out the whole process: issuing coins, building momentum, pulling plates, shipping, and running away. Two weeks to complete a harvest. According to the early 2025 report, nearly half of the Ether Token promoted in certain Telegram groups were confirmed to be rug pulls.

Truth #2: NFT Becomes the Most Expensive Digital Junk In 2024, the NFT market volume dropped 19% to $13.7 billion. 3,600 new NFT series pop up every month. 98% are losing money from the day they are minted. Buyers are standing on the edge of a cliff the first moment they buckle down on an extension. Those "blue chip NFTs" that used to sell for hundreds of thousands of dollars are now unloved in the secondary market. 76% of OpenSea's daily trading volume is down from the beginning of the year.

Truth #3: Gamblers Are Getting Richer and Richer The FBI reports that in 2024 there will be 140,000 complaints of cryptocurrency-related fraud, with losses totaling nearly $10 billion. Of these, the 60+ age group suffered the heaviest losses. But those lost dollars haven't disappeared, they've just moved to the wallets of others. When a 90-year-old Wenzhou guy makes $2 million in two days with a meme coin, the story goes viral in the community and becomes FOMO fuel for the next batch of leeks. No one will tell you that behind that $2 million dollars are hundreds of people emptying their savings.

Why is that?

The problem is not the technology. Blockchain, smart contracts, and decentralization are all wonderful ideas, but they're being used as the most efficient tool for cutting leeks.

Token economics is inherently flawed:

Most Web3 projects are financed by issuing Token, but Token is not equity or debt, and the holder is almost not binding on the project. Project owners and VCs have already taken most of the chips before the launch, and their goal is not to make a good product, but to sell the Token in their hands. Behind every slogan of "ecological incentives" and "community governance" is a well-designed unlocking schedule and shipping plan.

Anonymity + global mobility = regulatory vacuum:

The anonymity of blockchain is a double-edged sword. It protects user privacy and it protects fraudsters. When a project owner runs away with the money, you don't even know what country he is in. tokens can still be traded on any exchange, and cross-border recovery is almost impossible. Even if a country wants to regulate, there is no way to do so in the face of a decentralized structure.

Highly centralized under the guise of "decentralized":

An ironic fact: in most of the so-called "decentralized projects", half of the Token is in the hands of the project owner, VCs and early investors. They can decide when to go to CoinSafe, when to destroy the Token, and when to shut down liquidity. The thousands of coins in your hand are just plankton in front of the giant whale. But all of this is packaged in a glamorous way with the words "community-driven" and "DAO governance".

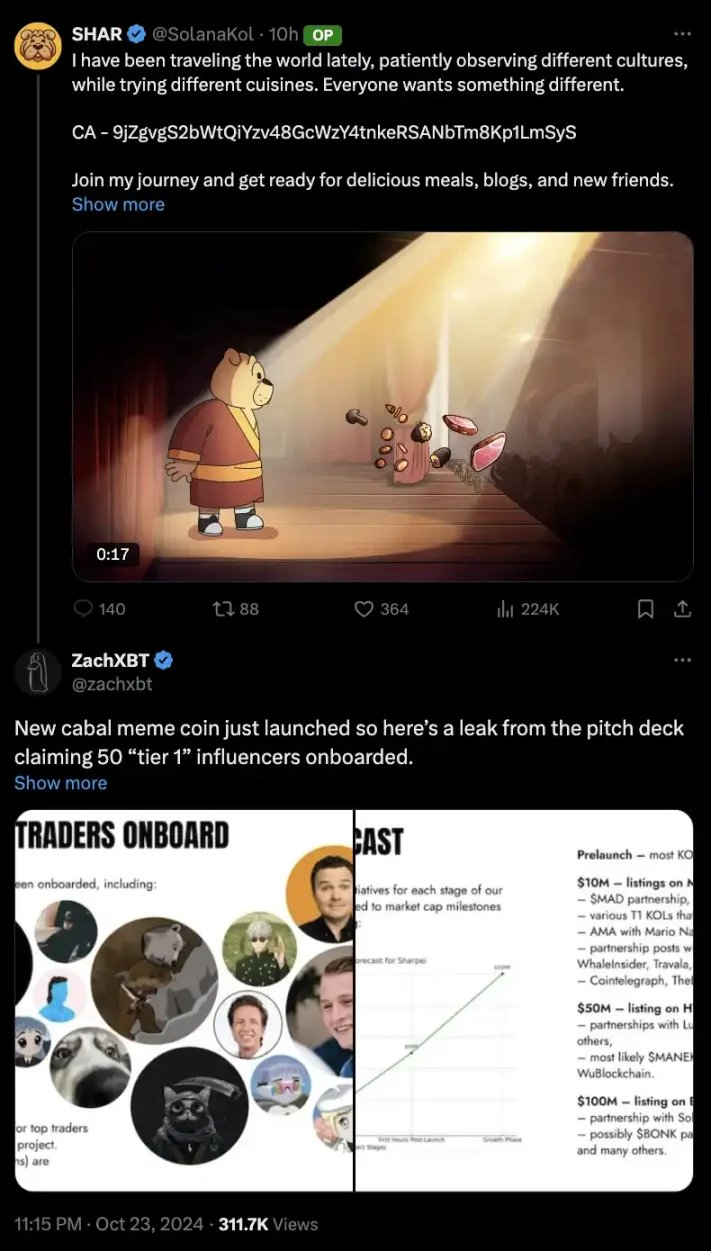

The interests of KOLs and the media are bound:

When a Twitter V tells you that a certain project is "promising", it's hard to know if he's really optimistic, or if he's already received advertisement fees or internal quotas.Web3 media ecosystem has almost no truly independent voices. In the Web3 media ecosystem, there are few truly independent voices, because in order to survive, you have to work with the program. Critics are labeled "FUD" (Fear, Uncertainty, Doubt) and called "old guys who don't know how to innovate."

What it takes to get out of the casino

Will Web3 always be a casino? Probably not. But a few key shifts are needed to step out.

Effective Regulation.

Not to kill innovation, but to establish clear rules. Who can issue coins, what are the responsibilities of those who issue coins, and what are the rights of investors - these are fundamental questions that can no longer be avoided by saying "code is law".

Real-world scenarios.

Stop wrapping everything in Token. If a product can work without tokens, don't force it to issue coins. the future of Web3 is not in PVP Texas Hold'em tables, but in products that solve real problems.

Industry self-cleaning.

Stop calling every critic a FUD, and stop responding to questions with "you don't understand". When an industry doesn't have the courage to admit its problems, it can't expect respect from the outside world. Until that day, Web3 will remain a casino.

⚠️If you choose to enter, at least understand which table you're sitting at.